> Taxation

The United Arab Emirates is known across the globe as a region where no income tax is levied on businesses. Taxation is very different here compared to the rest of the world, and so we can help you deal with taxes—in particular, Value Added Tax (VAT)—in the various ways described below.

The United Arab Emirates is known across the globe as a region where no income tax is levied on businesses. Taxation is very different here compared to the rest of the world, and so we can help you deal with taxes—in particular, Value Added Tax (VAT)—in the various ways described below.

Training

This page is for our taxation advisory under knowledge process outsourcing; if you are looking for VAT training for your employees instead, you will likely want to visit our training and development page under business process outsourcing.

> VAT and Tax Advisory

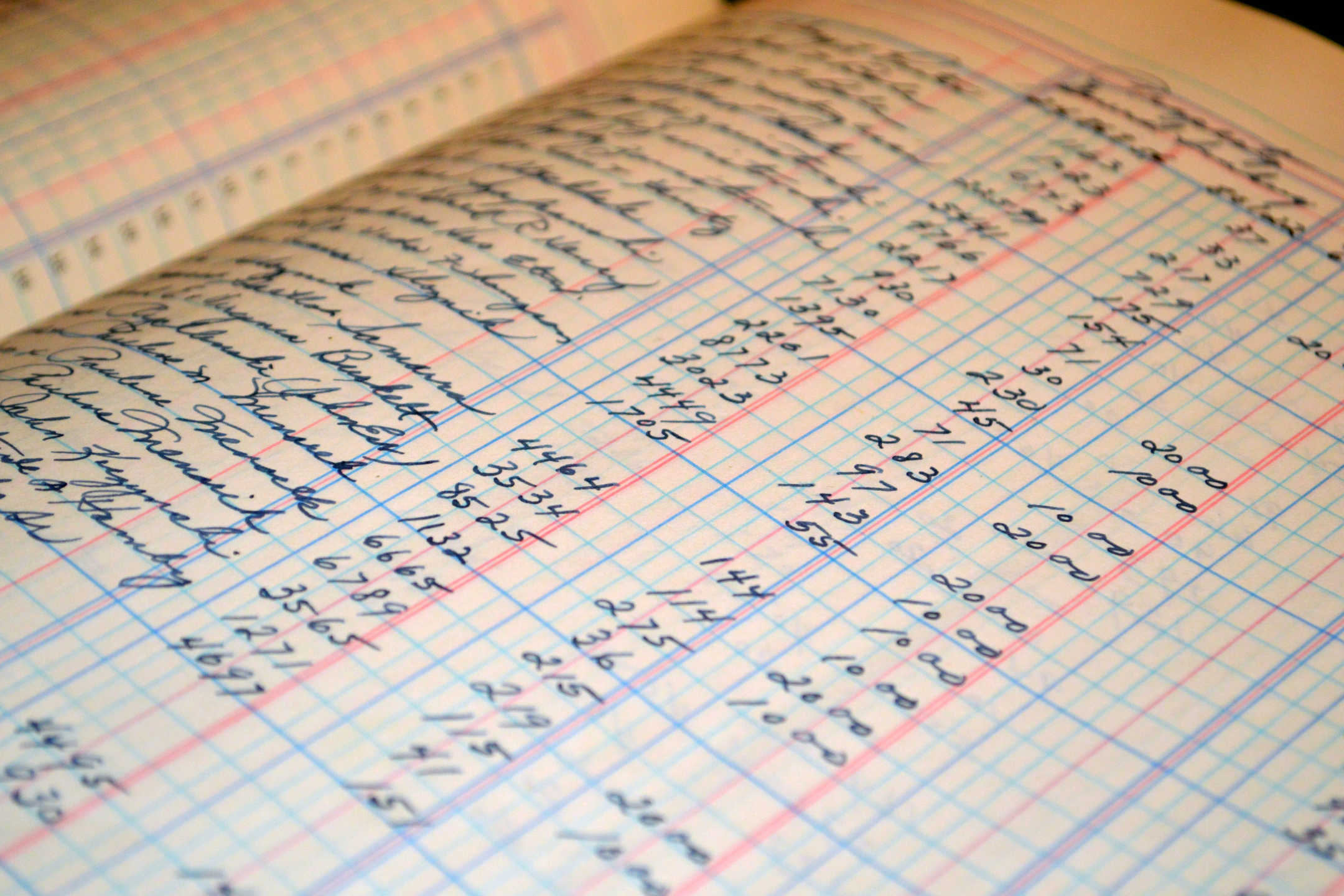

Tax optimization, VAT advisory, training services and implementation are one of the core services we provide. Our team of experts include tax accountants, tax advisers and finance experts, experienced in thoroughly analyzing the relevant books and accounts of your company before carrying out the appropriate VAT services. We ensure that all matters relating to taxation are dealt with timely and efficiently.

> VAT Implementation

VAT was made effective in the United Arab Emirates beginning 2018, which means that it is a very recent phenomenon. For that reason, it is expected to take significant time before the country experiences an abundance of VAT experts. Our professionals, however, have a prior background in VAT, and therefore have relevant experience in this field. We know how to handle VAT at every stage of a company's supply network.

> VAT Consultant

Our VAT consultants will work towards gaining a thorough understanding of your business before suggesting VAT-related areas that require rectification or correction. Furthermore, we will arrange training sessions to familiarize your employees with VAT laws, terms and jargon. Besides that, VAT consultancy includes recommendations, meetings and discussions to mitigate confusions and solve problems regarding VAT.

> Key VAT Points

VAT regulations usually have a strong impact on investors and companies, and the variation in percentage can mean a lot to a business and its future model of operations. The recent introduction of VAT in the UAE at a 5 percent rate, applicable a number of products, has radically changed the way business entities used to approach investments. At this point in time, the services of professional firms like us become vital, because we have a clear understanding of how to take a company through all the necessary paperwork and other legal and operational formalities—Tax Registration Number (TRN) for one.

> VAT Fines

You most certainly do not want to get your company fined over a violation of VAT laws, or anything else for that matter. We can help you be compliant so that you avoid the various VAT-related fines in the UAE:

- every company has to keep accounting records for the previous five years, counted from the company's final fiscal year (Company Law, Article 26);

- a company that fails to keep accounting records to explain its transactions is liable to a fine ranging from 50,000 to 500,000 AED (Company Law, Article 348); and,

- a company that fails to keep accounting records for the stipulated period of five years is liable to a fine ranging from 20,000 to 200,000 AED (Company Law, Article 349).

> VAT Frequently Asked Questions

> When did VAT come into force?

In the UAE, VAT legislation was effective starting January 1, 2018.

> How does the UAE collect VAT?

Companies are responsible for filing their income, costs and applicable VAT charges. Registered companies as well traders charge VAT (output TAX) to their customers at the present rate and incur VAT (input TAX) on goods and services bought from suppliers. The difference between amounts is reclaimed or paid to the government.

> Is VAT applicable to all products and services?

Certain products and services are explicitly exempted from VAT in the law. All other products and services, however, are subject to VAT.

> Do I need to be registered for VAT?

In the UAE, companies with a taxable turnover (calculated as the total value of VAT-subject goods supplied and imported) that exceeds AED 375,000 in a 12-month period are required to register for VAT. Companies that have a lower taxable turnover but still above AED 187,500 may voluntarily register for VAT.

> How can I register for VAT?

VAT registrations are handled online on the Federal Tax Authority's website.

> How often do I need to file for VAT?

Normally, companies registered for VAT will be given a certain day of the month by which they have to file for VAT—this means that, on average, they will need to file for VAT every 30 days. In case this day falls on a national holiday or weekend, they will have to file for VAT by the next working day.

> What is the status of VAT in Islamic finance?

The products of Islamic finance are in accordance with the principles of Shariah law, and because of that, their operations are somewhat different from conventional financial products that are generally accepted internationally. For the smooth functioning of business and governmental operations, VAT treatment has been kept aligned with both the Islamic financial system and the conventional financial system.

> VAT Appeasement and Appeals

At this point in time, the GCC Unified Agreement on Value Added Tax (GCC UAVAT) has been published in the Official Saudi Gazette, and its English version has also been issued. In all six GCC countries, the GCC UAVAT serves as the foundation of the VAT system. This unifies the intricacies of VAT across all GCC countries, making it more uniform than if individual member countries were to create their own VAT systems from the ground up. For companies in GCC countries, it is crucial to provide tax returns, payments, tax periods and refund details.

> VAT Compliance Audit

With VAT being another one of the many burdens on companies, many of them end up either miscalculating it completely or do not manage to file it on time. This puts them in a very awkward position, and only in hindsight do they realize that it would have been better for them if they had formerly opted to utilize professional firms that specialize in this subject. If your company has the vision to foresee problems before they arise, it is imperative it contacts us to handle compliance with VAT. Our experts perform VAT compliance audits and manage sales tax invoices, correct bookkeeping errors like the overstatement of sales invoices and more.

> VAT Return Filing

Businesses that provide products or services subject to VAT are required to register themselves with the Federal Tax Authority and pay their tax dues on a regular basis (as defined by the FTA). In order to make this simple for your company, we provide comprehensive tax/VAT advisory and consultancy services. This means:

- we ensure timely filing of VAT returns;

- we compile all necessary documents relevant to VAT at the end of each tax period;

- we represent the company in case it is required to appear before the authority of the law; and,

- we minimize tax burden by utilizing loopholes in VAT laws.